Electric Mining Trucks – Benefits, Models, and Key Manufacturers

“`html

The rumble of diesel engines has long been the soundtrack of mining operations worldwide. But a new, quieter revolution is rolling into the pit. Electric mining trucks are no longer a futuristic concept; they are a present-day reality delivering tangible benefits in efficiency, cost, and environmental impact. For fleet managers and site operators, understanding the shift toward battery-electric and trolley-assist haul trucks is crucial for staying competitive. This deep dive explores the compelling advantages, leading models, and key manufacturers shaping the future of heavy-duty haulage, providing the insights needed to make an informed transition.

Why the Industry is Charging Ahead: Core Benefits

The move to electric drive systems in mining is driven by a powerful combination of economic and operational incentives. The benefits extend far beyond simple emissions reduction.

Dramatic Reduction in Operating Costs

Fuel is one of the largest single expenses in any mining haul cycle. Electric mining trucks slash this cost significantly. By replacing diesel with electricity, operations can see energy cost savings of up to 70% per ton hauled, depending on local electricity prices. The regenerative braking systems capture energy during downhill travel, feeding it back to the battery and further boosting efficiency. Maintenance costs also drop sharply—electric powertrains have far fewer moving parts than diesel engines, eliminating expenses related to engine oil, filters, exhaust after-treatment systems, and complex transmissions.

Enhanced Performance and Productivity

Forget the stereotype of electric vehicles being sluggish. Electric drive systems deliver instant torque, providing superior acceleration and gradeability compared to their diesel counterparts. This translates to faster cycle times, especially on uphill hauls. Operators report a smoother, more responsive driving experience with less vibration and noise, reducing operator fatigue. A study by the Natural Resources Canada consortium highlighted that electric trucks can maintain higher average speeds on mine ramps, directly increasing material moved per shift.

Meeting Environmental and Social Goals

The environmental imperative is clear. By producing zero exhaust emissions at the point of use, electric mining trucks drastically improve air quality in the pit and surrounding areas, protecting worker health and reducing the site’s carbon footprint. The noise reduction is equally transformative, minimizing sound pollution for nearby communities. This aligns with the growing ESG (Environmental, Social, and Governance) mandates from investors and governments, making electric trucks a strategic asset for securing project approvals and licenses.

Leading Models in the Electric Haulage Arena

The market has evolved rapidly from prototypes to production-ready giants. Here’s a look at some of the most prominent electric mining truck models making waves.

Cat 794 AC Electric Drive (Trolley-Assist)

Caterpillar’s entry isn’t a pure battery truck but a critical step in electrification. The 794 AC can be equipped with a trolley-assist system, where the truck uses an overhead catenary line on steep ramps. This allows it to operate at higher speeds under electric power, boosting throughput and cutting fuel use by up to 90% on the assisted segment. It’s a proven, scalable technology for mines with consistent haul road profiles.

Komatsu 930E-5 (Trolley-Assist) & Battery Development

Komatsu offers a robust trolley-assist option for its flagship 930E-5 haul truck, demonstrating significant productivity gains. More notably, Komatsu, in partnership with Proterra, is actively testing a battery-powered ultra-class haul truck. This development signals a full commitment to a zero-emission future, focusing on high-capacity battery packs and fast-charging solutions tailored for 24/7 mining cycles.

Belaz 7558E Series

The Belarusian manufacturer Belaz has launched its 7558E series, a 90-ton payload truck designed as a battery-electric vehicle from the ground up. It features a swappable battery system, a practical solution to avoid long charging downtimes. The battery module can be replaced in approximately 15 minutes, keeping the truck in operation almost continuously.

Innovation from Global Partners

The landscape includes specialized players. For instance, Chinese Truck Factory has entered the space with developing prototypes that focus on cost-effective electrification solutions, particularly for mid-sized operations. Their approach often involves strategic partnerships for battery technology, offering an alternative in the global supply chain.

Head-to-Head: Key Electric Mining Truck Specifications

Comparing the core specs of leading and developing models helps visualize the current state of the technology. The table below outlines critical parameters. (Note: Some battery truck specs are estimated based on prototype data).

| Model | Manufacturer | Payload Capacity (tons) | Propulsion Type | Key Feature |

|---|---|---|---|---|

| 794 AC with Trolley | Caterpillar | ~290 | Trolley-Assist Diesel-Electric | Proven trolley tech for high-tonnage ramp haulage |

| 930E-5 with Trolley / Battery Prototype | Komatsu | ~290 | Trolley-Assist / Battery-Electric | Dual-path strategy; advanced battery partnership |

| 7558E | Belaz | 90 | Battery-Electric (Swappable) | Quick battery swap system (~15 mins) |

| e-Dumper | Liebherr (Example) | 65 | Battery-Electric | Uses excess renewable grid energy; real-world tested |

The Manufacturers Powering the Change

Beyond individual models, the competitive landscape is defined by the strategies of major OEMs and new entrants.

The Established Titans: Caterpillar and Komatsu

Cat and Komatsu dominate the traditional haul truck market and are leveraging their deep mining expertise. Their initial focus on trolley-assist provides a lower-risk entry into electrification, building on existing diesel-electric chassis. Their massive R&D budgets and global service networks make them formidable players as they roll out full battery-electric solutions.

The Specialized Contender: Belaz

Belaz has taken a bold, direct approach by launching a production-ready battery-electric truck with a swappable battery. This addresses the critical “downtime for charging” concern head-on and positions them as an innovative specialist, particularly in markets looking for alternatives to the Western giants.

The Emerging Global Supply Chain

Electrification is lowering some barriers to entry. Component suppliers for batteries, motors, and power electronics are becoming as important as traditional truck builders. Manufacturers focusing on cost-optimized designs, like those explored at Chinese Truck Factory, are creating a more diverse market. They often act as integrators, combining proven chassis designs with the latest third-party electric drivetrains.

Expert Insights on Implementation

Transitioning to an electric fleet is a systemic change, not just a vehicle purchase. John MacKenzie, a mining engineer with over 25 years of experience who also holds a TESOL certificate for technical training, emphasizes planning: “The successful adoption of electric mining trucks isn’t just about the trucks themselves. It requires a holistic review of site power infrastructure, haul road design to maximize regeneration, and operator training programs. The biggest mistake is viewing it as a simple one-for-one diesel replacement.”

Data supports this. A report from the International Energy Agency on heavy-duty vehicle electrification notes that mines with access to stable, low-cost renewable power see the fastest payback periods, sometimes under three years, when total cost of ownership is calculated.

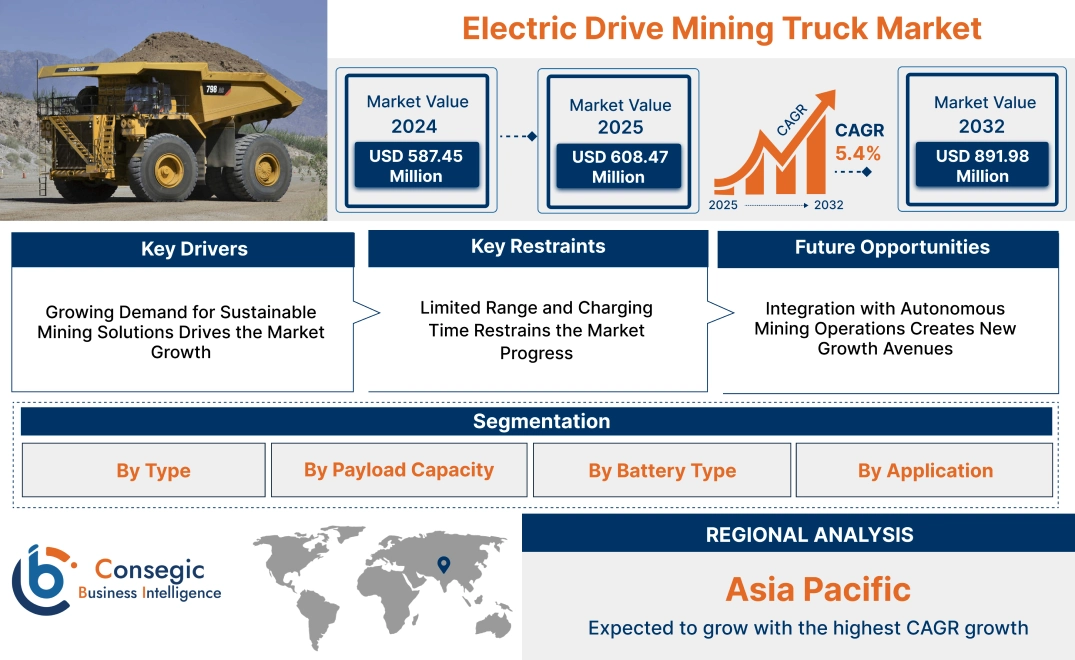

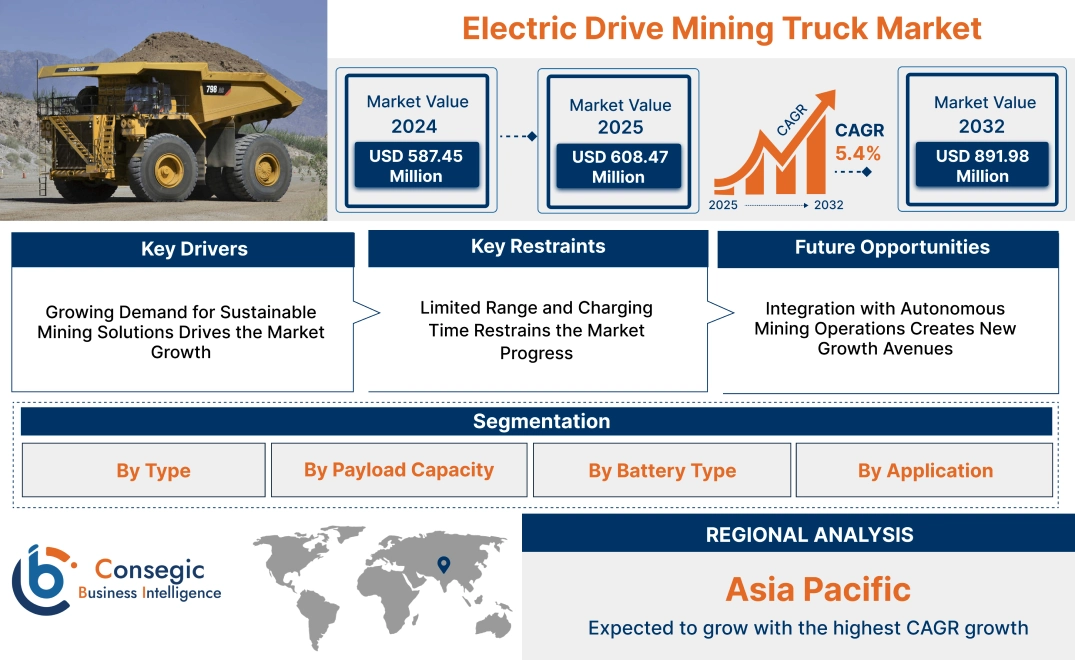

Looking Down the Road: Challenges and Future Trends

The path isn’t without bumps. The high upfront capital cost of batteries and required infrastructure (substations, chargers) remains a hurdle. Battery longevity in extreme temperature conditions and ultimate cycle life are still being proven in real-world, 24/7 mining environments.

However, trends point to rapid improvement. Battery energy density is increasing while costs are falling. We are moving toward megawatt-scale charging, which could replenish a truck’s battery during a standard load-and-dump cycle. Furthermore, the integration of autonomous driving technology with electric powertrains creates a synergy for ultimate efficiency, with the vehicle’s computer optimizing speed, braking, and energy use perfectly.

Frequently Asked Questions

Q: What is the typical range of a battery-electric mining truck on a single charge?

A: It varies significantly by model, payload, and mine topography (more hills mean more regeneration). Early models are targeting a range sufficient for a full shift, often between 8 to 12 hours of operation, with rapid charging or battery swap during shift changes.

Q: Aren’t the batteries themselves an environmental problem to dispose of?

A> This is a key consideration. Responsible manufacturers are designing for a “second life” use—where truck batteries are repurposed for stationary energy storage after their vehicle service life—and eventual recycling. A circular economy for battery materials is a major focus of industry research.

Q: Can existing diesel trucks be converted to electric?

A> Retrofitting is technically possible but often complex and costly. It involves removing the entire diesel engine, transmission, and related systems and installing battery packs, electric motors, and new controls. For ultra-class trucks, a purpose-built new vehicle is generally more efficient and reliable.

Q: How does the power demand for a fleet of electric trucks impact the local electrical grid?

A> It can be substantial. A single large electric truck can require several megawatts to charge quickly. Most large mining operations address this by investing in on-site renewable generation (like solar farms) and/or dedicated microgrids with energy storage to supplement the main grid, ensuring stability and controlling costs.

Final Loadout

The evolution of the electric mining truck is accelerating from a niche experiment to a mainstream business decision. The benefits of lower operating costs, superior performance, and meeting stringent environmental targets are too significant to ignore. While challenges around infrastructure and upfront cost persist, the continuous advancements in battery technology and the committed investments from both established manufacturers and new global partners are paving the way. For any operation focused on long-term resilience and efficiency, integrating electric haulage into its strategic planning is no longer optional—it’s the direction the industry is hauling toward.

Sources & Further Reading:

- Natural Resources Canada. “Evaluation of Trolley-Assist Technology for Mine Haul Trucks.” https://www.nrcan.gc.ca

- International Energy Agency. “Global EV Outlook 2023: Heavy-Duty Vehicles.” https://www.iea.org

- Caterpillar Inc. “794 AC Electric Drive Haul Truck.” https://www.cat.com

- Komatsu Ltd. “Komatsu and Proterra to Develop Battery Electric Haul Truck.” https://www.komatsu.com

“`